What Our Customers Are Saying

Don't just take our word for it, here's what others have to say about us!

facebook Reviews

Google Reviews

Our Motivated Memphis Movers

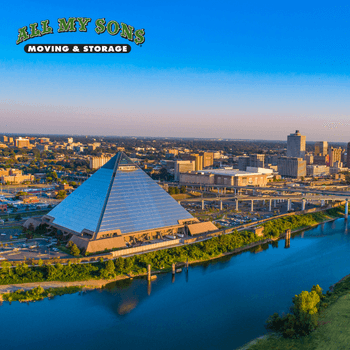

All My Sons Moving & Storage Tennessee

If you're making a move to Memphis or are relocating within the city, All My Sons Moving & Storage is the Tennessee moving company to help you. You couldn't have picked a better city for delicious barbecue, great tunes, and fantastic events! To make your move that much more significant, you can call on our Memphis movers for a hassle-free and easy moving experience.

Contact All My Sons Moving & Storage of Memphis

Name : All My Sons Moving & Storage of Memphis, LLC

Address : 5454 Summer Ave., Memphis, TN 38134

Phone : (901) 440-0921

Sunday 9AM-7PM

Monday 7AM-9PM

Tuesday 7AM-9PM

Wednesday 7AM-9PM

Thursday 7AM-9PM

Friday 7AM-9PM

Saturday 7AM-9PM

Moving and Storage Services Near Me in Memphis

Having spent more than 30 years moving families and businesses across the United States, we know what our clients expect from a top-quality moving company. At All My Sons Moving & Storage, our team works with property owners, tenants, and businesses to deliver a full-service moving experience. Here are some of our most popular moving services.

Local Movers Serving Memphis and the Surrounding Areas

Luckily, as a full-service moving company, our Memphis local movers will take care of all aspects of your move, from start to finish. Our local movers in Memphis will handle everything, eliminating significant stress from your move. Our professional moving team is here to care for all your moving needs. We will work to make the experience hassle-free and easy. Good help can be hard to find, but here at All My Sons Moving & Storage we pride ourselves on being one of the best moving companies in Memphis, Tennessee. We want to help make moving to Memphis a great experience by taking care of the entire process for you!

Trusted Long-Distance Movers

Do not worry if you believe you are located too far for most moving companies. Our Memphis long-distance movers can make your relocation happen. Our house movers in Memphis, TN, will provide superb moving services to make your moving experience positive. So please take advantage of our quality services and anticipate a smooth move to Memphis. You can put your trust in our Memphis long-distance movers to take care of your next move, no matter the distance.

First-Class Corporation Relocation Movers in Memphis

Relocation specialists are available to take care of every aspect of your move. A tailored moving plan will be developed for your specific moving needs so that your Memphis movers will arrive ready to perform quickly and efficiently on moving day. We can assist you with any type of move, including commercial moves in Memphis and corporate relocations. You spell it out, and our moving staff can help you. There's no move too great for our professional team!

Safety is a priority for our team, and we suggest you utilize our custom packing services that offer superior protection for your dishes, furniture, electronics, and other specialty items. You can even request that our home movers in Memphis bring our durable and sturdy moving boxes and packing supplies to you. You won't have to worry about finding all those cardboard boxes since we can provide you with professional packing materials. Be sure to take advantage of our top-of-the-line packing services in Memphis!

Main Benefits of Working With Our Memphis Moving Company

Our professional movers have worked with countless families and businesses in the surrounding areas. We are focused on delivering the best experience for our clients, including the following benefits and more.

Customer-focused solutions - We develop a moving plan to fit your specific needs - whether you're a residential or business client - and stay in close contact from start to finish.

Affordable and accurate quotes - Clients can get a free quote that covers every part of the move, including packing, loading, and transportation.

Licensed and insured team - We are fully licensed and insured so our customers can relax, knowing they're in good hands.

Safe working practices - We adhere to best safety practices to ensure the protection of our workers and your belongings.

Dependable planning and moving service - Our experience in moving clients across the United States means we know how to create a solid plan and hold to it.

High-quality equipment - We use top-quality, well-maintained moving equipment to safely and efficiently transport your possessions.

What Won't Movers Move?

At All My Sons Moving & Storage, we strive to handle a wide range of items to make your moving process as smooth as possible. However, there are certain items that we typically cannot transport due to safety, legal, or practical reasons. Please note that these restrictions may vary depending on our company policies and local regulations. Here are some common examples of items we may refuse to transport:

- Hazardous Materials: We prioritize the safety of our movers and transportation vehicles, which is why we cannot transport hazardous materials such as explosives, flammable substances, corrosive chemicals, or toxic materials.

- Perishable Goods: To ensure the freshness and integrity of your belongings, we are unable to transport perishable items like food, plants, or live animals, as they may spoil or suffer harm during transit.

- Valuables and Personal Documents: We highly recommend keeping valuable items such as jewelry, cash, important documents (e.g., passports, financial records), or sentimental items (e.g., photo albums) with you rather than entrusting them to us. This ensures their security and peace of mind for you.

- Firearms and Ammunition: Depending on local laws and our company policies, firearms and ammunition may not be allowed in our moving trucks. We kindly ask that you check local regulations and discuss these items with us beforehand.

- Restricted or Illegal Items: We strictly adhere to the law and will not transport items that are prohibited or restricted, such as illicit drugs, stolen goods, or contraband.

- Certain Electronics: Some electronics with sensitive components or high value may have limitations on transportation. We recommend reaching out to us to inquire about any specific restrictions regarding electronics.

- Plants and Soil: Due to agricultural regulations and concerns about pests or diseases, we are unable to transport plants, especially across state or international borders. We understand that every move is unique, and we encourage you to communicate with us to understand our specific policies and any items we may refuse to move. Our team is here to provide you with comprehensive information and guidance, ensuring a successful and stress-free moving experience.

Is It a Good Idea to Move to Memphis?

If you like your city with a side of soul, barbecue, and history, then yes—moving to Memphis might be one of your better life decisions. Memphis blends Southern hospitality with a low cost of living, a thriving music scene, and job opportunities in healthcare, transportation, and logistics. People who move here often find themselves charmed by the river views, porch-sitting neighborhoods, and surprisingly rich culture tucked into every block. While it's not without challenges (yes, summers are humid), the overall quality of life here can be a major draw.

Plus, there’s something empowering about living in a city that’s reinventing itself. Memphis continues to grow and attract young professionals, families, and creatives looking for affordable city life with a unique cultural identity. From Beale Street to Shelby Farms Park, there’s a rhythm in this city that many are happy to call home.

How Do I Move a Piano?

Moving a piano is a delicate and challenging process that necessitates careful planning and execution to guarantee the safety of both the piano and the movers. We are happy to share some essential steps to help you move your piano smoothly. First, assess the type and size of your piano as grand pianos and upright pianos require different moving considerations. Gather the necessary equipment, such as heavy-duty furniture straps, moving blankets, padding, a dolly or piano skid, and enlist strong helpers to assist you. Measure doorways and pathways to ensure the piano can fit through without any issues. Clear any obstacles or furniture that might obstruct the path. Prepare the piano by closing the lid, securing it with tape or straps, and wrapping it in protective moving blankets or padding to safeguard it from scratches and damage during transportation.

Next, secure the piano to a dolly or piano skid, carefully tilting the instrument onto it. Fasten the piano securely to the dolly or skid using straps or ropes. When lifting the piano, employ proper lifting techniques with the assistance of strong individuals, ensuring you bend your knees, lift with your legs, and maintain a straight back. Take breaks as needed to prevent strain or fatigue. Moving the piano should be done slowly and steadily, with all helpers coordinating their movements. Exercise extra caution when navigating stairs or uneven surfaces. Protect floors and walls by placing moving blankets or cardboard to prevent any damage during the move. When loading the piano into the moving vehicle, it is recommended to secure a grand piano on its side in a specialized piano moving truck or a well-padded enclosed moving van. For upright pianos, carefully position them upright against the wall of the vehicle, ensuring stability and preventing tipping.

Secure the piano inside the vehicle using straps or ropes to immobilize it during transportation. Drive carefully, avoiding bumps, sharp turners, and sudden stops. Protect the piano from extreme temperatures and direct sunlight. Upon arrival at the new location, follow the steps in reverse to unload and position the piano safely. Ensure that the piano is placed on a flat and stable surface and properly leveled. While these steps provide guidance for moving a piano, it is crucial to note that piano moving can be intricate. Hiring professional piano movers with expertise and specialized equipment is often the best choice. They possess the necessary experience to protect the instruments and can provide comprehensive services for a smooth and successful move.

What Are the Best Neighborhoods in Memphis?

The best Memphis neighborhoods really depend on your lifestyle and what you're looking for, but here are a few standout picks:

Midtown – Known for its eclectic vibe, artsy homes, and walkability to local bars, coffee shops, and Overton Park.

East Memphis – A popular choice for families and professionals, offering good schools, quiet streets, and convenient access to shopping and offices.

Downtown – Perfect if you're into urban living, loft-style apartments, and being near the Mississippi River, music venues, and nightlife.

Cooper-Young – Funky and full of character, this area is a favorite among young professionals and creatives.

Cordova – Suburban living with plenty of big-box stores, parks, and easy access to the rest of the city via major roadways.

Each of these neighborhoods offers its own personality, so touring a few in person is a smart way to see what feels like home.

What Are Things to Discuss Before Moving in Together?

Moving in together is a significant milestone in a relationship, and it is crucial to engage in open and honest discussions with your partner before taking this step. These conversations will help ensure a seamless transition into cohabitation. We gladly share some important topics to discuss before moving in together. First and foremost, share your individual goals and expectations for the future, both personally and as a couple. Discuss long-term plans, career aspirations, family goals, and living arrangements to ensure you are aligned. Having an open conversation about finances is essential. Discuss income, debts, and financial responsibilities. Establish how you will split expenses, manage joint finances, and handle budgeting, bills, and savings.

Address household responsibilities and establish a fair division of chores. Talk about each other's preferences, and find a system that feels balanced for both parties. Share your living habits, routines, and cleanliness preferences. Be open about expectations for personal space, alone time, and guests. Find compromises that accommodate both of your needs. Discuss communication styles, expectations, and conflict resolution strategies. Establish healthy patterns of communication and commit to open and respectful dialogue. Respect each other's personal boundaries and discuss specific needs regarding personal space, privacy, and shared belongings. Build mutual understanding and respect for each other's boundaries. Ensure that you and your partner are on the same page regarding the level of commitment to the relationship and the future discretion of your partnership.

Talk about your individual and shared goals for the future, including topics such as marriage, children, career aspirations, and other significant life events. Ensure you have a shared vision and are aligned with your expectations. Discuss practical aspects like the location of your new home, lease or ownership agreements, furniture, and other logistical details. Clarify responsibilities regarding moving logistics and necessary preparations. Be open about personal habits, preferences, and lifestyle choices that may impact your shared living environment. Discuss factors such as smoking, pets, dietary preferences, and any other relevant considerations. Remember, these discussions are meant to foster understanding, mutual respect, and alignment of expectations. Approach them with empathy, actively listen to your partner, and be willing to compromise. Moving in together should be a collaborative decision that strengthens your relationship and establishes a solid foundation for your shared future.

What Are Some of the Best Museums in Memphis?

Memphis has a reputation for music, culture, and history, and its museums reflect that spirit. If you’re a fan of music history, the Stax Museum of American Soul Music is a must-visit. It takes you deep into the roots of soul music, highlighting legends who shaped the genre. For something equally iconic, Graceland offers an inside look into Elvis Presley’s life and legacy, and it remains one of the city’s most-visited attractions. Beyond music, Memphis also has the National Civil Rights Museum, which is located at the former Lorraine Motel where Dr. Martin Luther King Jr. was assassinated. This museum offers powerful exhibits that trace the history of the civil rights movement in America. If you want something lighter, the Memphis Brooks Museum of Art is another gem, offering everything from classical works to contemporary pieces. Memphis truly has a museum for every interest, whether you’re passionate about art, history, or music.

Professional Residential and Commercial Movers in Memphis

All My Sons Moving & Storage is a leading provider of residential and corporate moves in Memphis. We help clients with local and long-distance relocations throughout the United States. We have been moving families in Memphis and across the country for more than 30 years. Our Memphis moving company knows everything there is to know about relocating to this growing region. So don't let your move begin with a stressful experience. To discuss your next move, call (901) 440-0921 or request a free moving quote so we can get you moving with the best team in Memphis!